Forex trading, with its enticing promise of substantial profits, is a dynamic and highly competitive arena. However, it is also fraught with risks that can lead to substantial losses if not managed properly. One of the most powerful tools at a trader’s disposal for risk management is the stop-loss order. In this article, we’ll delve into why stop-loss trading is so important in Forex trading.

1. Defining the Stop Loss Order:

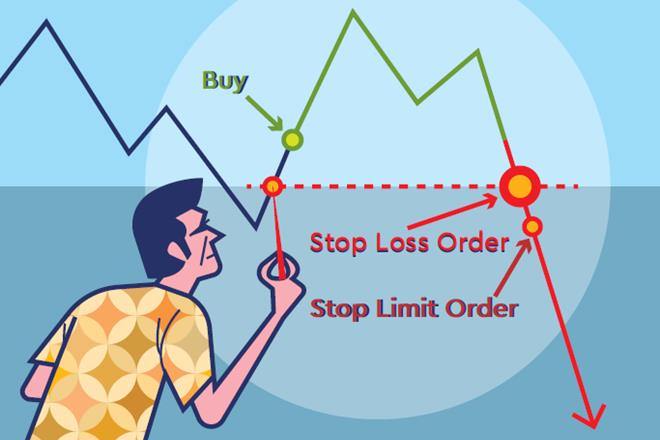

Before we dive into its importance, let’s clarify what a stop-loss order is. A stop loss is an automatic order placed with your broker to sell a currency pair when it reaches a certain price level, designed to limit potential losses.

2. Preservation of Capital:

The primary reason why stop-loss orders are crucial in Forex trading is capital preservation. In trading, protecting your capital is paramount. Without capital, you can’t participate in future trading opportunities. By setting a stop loss, you define the maximum amount of capital you’re willing to risk on a particular trade. This disciplined approach helps ensure that you don’t wipe out your entire account on a single bad trade.

3. Emotion Control:

Human emotions can be a trader’s worst enemy. Fear and greed often cloud judgment and lead to impulsive decisions. Stop-loss orders act as a safety net, removing the emotional component from trading. When your predetermined stop level is hit, the trade is executed automatically, preventing you from making emotional decisions like holding onto a losing position in the hopes it will recover.

4. Risk Management:

Effective risk management is essential in Forex trading. Stop-loss orders enable you to quantify and control the risk on each trade. By setting a stop level, you determine in advance how much you’re willing to lose. This allows you to size your positions accordingly and maintain a balanced risk-reward ratio in your trading strategy.

5. Adaptation to Market Volatility:

Forex markets can be highly volatile, and prices can fluctuate rapidly. Without a stop loss, you might find yourself in a situation where a small adverse movement turns into a significant loss. Stop-loss orders help you adapt to market conditions by adjusting your exit point based on the current price movement, providing a crucial buffer against unexpected market events.

6. Consistency and Discipline:

Consistency and discipline are the hallmarks of successful Forex traders. By incorporating stop-loss orders into your trading plan, you establish a consistent approach to risk management. This discipline helps you stick to your strategy, avoid impulsive decisions, and maintain a structured trading routine.

Conclusion:

In the world of Forex trading, where fortunes can be made and lost in an instant, stop-loss orders are an indispensable tool for traders seeking to protect their capital, manage risk, and maintain discipline. They provide a crucial safety net that separates successful traders from those who let emotions dictate their actions. Incorporating stop-loss orders into your trading strategy is not just a good idea; it’s a fundamental step towards long-term trading success.

Remember, while stop-loss orders can help mitigate risk, they are not a guarantee against losses. They should be used in conjunction with a well-thought-out trading plan and risk management strategy to maximize their effectiveness in your Forex trading journey.

Beginner’s Guide: How to Choose the Best Forex Broker

The Best Way to Learn Forex Trading for Beginners: A Comprehensive Guide